Ready for volatile markets

Financial markets have now returned to pre-crisis levels. Market sentiment is optimistic, but the environment remains volatile after the turbulent last year of investing. How should investors position themselves to benefit from current opportunities and continue to consistently pursue their long-term investment strategy?

The atmosphere of crisis has long since vanished on the stock exchange

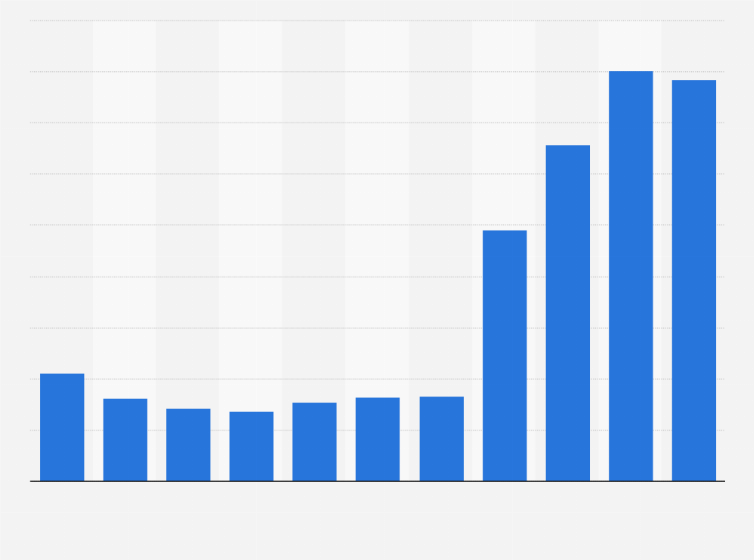

Share prices recovered surprisingly quickly after the stock market crash in March 2020. “The expansionary monetary policy of the central banks, the state bailout packages and the hopes of an end to the pandemic are supporting financial markets favorably,” explains Matthias Geissbühler , Investment Manager of Raiffeisen Switzerland.

However, uncertainties remain: the new lockdown is holding back the economic recovery and the indebtedness of governments and companies is constantly increasing. Several stocks are now highly valued, especially tech stocks. On Wall Street, small shareholders have recently opposed the investor elite – keyword GameStop. And with the inauguration of the new American President Joe Biden, the geopolitical situation is changing.

It is time to analyze the situation

In this uncertain environment, it is advisable to do a situation analysis: “In view of the persistent high volatility, investors should now look at the opportunities and risks relating to their portfolios,” says Matthias Geissbühler. The last twelve months have shown what this analysis consists of. Well diversified portfolios absorb the stress of the markets much better than one-sided portfolios. “Good diversification is now more important than ever,” emphasizes Raiffeisen’s Head of Investment.

How important a balanced investment mix is is evidenced by the significant differences in terms of performance: Tech or Medtech stocks have significantly gained in value. Many sustainable investments have also proved resilient to the crisis. Conversely, cyclically dependent stocks such as those of airlines, industrial and leisure companies and oil companies declined.

Avoid big risks

Through an in-depth portfolio analysis, major risks in certain asset classes and in different classes, sectors or even regions are highlighted. At the same time, corrective measures can be implemented and appropriate additions to the portfolio can be found. “Considering the growing corporate debt, we should consistently focus on quality, ie companies with a healthy balance sheet,” says Matthias Geissbühler.

Raiffeisen’s investment experts see opportunities especially in actions benefiting from the EU’s “Green Deal”, whose objectives, with the new President, are again also supported by the USA. In addition to the short-term Covid-19 rescue packages, related infrastructure programs are being prepared with a long-term horizon. This stimulates infrastructure and industrial stocks in the renewable energy sector and is, in principle, in favor of sustainable investment.

Gold and real estate remain safe values

Although equities are currently often referred to as ‘no alternatives’, it would be extremely risky to invest all of your assets exclusively in this asset class. Rather, it is a question of achieving the greatest possible diversification in terms of investment classes. Precious metals, real estate and bonds have once again demonstrated their stabilizing effect during the recent stock market crashes.

Gold is now a safe haven in two respects: if hopes of an imminent end to the pandemic are disappointed, the precious metal’s role as a safe haven will be further consolidated. If we can get the coronavirus under control soon, and if the economy reacts quickly, gold will be a good hedge against inflation. The latter scenario should not be underestimated, as Matthias Geissbühler points out: “Further stimulus packages could revive economic growth faster than expected and thus lead back to inflation. However, the market has so far completely ignored the short-term inflation risk. ”

Investments in real estate also remain attractive. The real estate market was little affected by the crisis and will be further strengthened by the persistence of low interest rates. “The focus should be mainly on residential buildings. There is little potential left in commercial real estate, ”says Geissbühler. Opportunities are offered in particular by Swiss real estate funds, which recorded an increase of around 8 percent in 2020. With a distributed yield of 2.4 percent, they have a premium of around 3 percent over government bonds – so it’s worth continuing a relative redistribution in the portfolio.

Rebalancing balances the portfolio

The sharp fluctuations in prices over the last twelve months have left traces in the portfolios: due to the changes in the value of the various investment instruments and equities, the composition often no longer corresponds to the strategic asset allocation pursued. In these cases it is advisable to resort to rebalancing. If, for example, the percentage of your US stock, real estate or gold portfolio has increased due to strong price gains, the share can be restored to the desired proportion by taking profits in these categories and by making purchases in others. «Rebalancing forces you to invest in a countercyclical sense. This generates return opportunities because you are one step ahead of the market, ”notes Matthias Geissbühler.

Furthermore, volatile markets offer the opportunity to take advantage of tactical opportunities. To ensure that the strategy does not turn out to be a rigid corset, a distinction must be made between strategic and tactical asset allocation. In this context, the strategic asset allocation of assets establishes the long-term orientation and defines the application ranges for the individual asset categories. Within these application bands, in line with the risk profile, investors can react to short-term market developments in the context of tactical asset allocation.